Need any help? Contact us:

Table of Contents

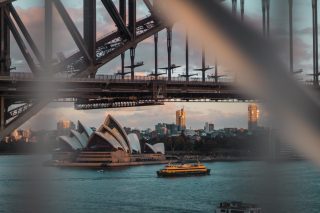

How To Set Up A Business As a Foreigner In Australia

As one of the larger economies in the world with a large middle and upper-middle class citizenship, Australia has always been an attractive market for business expansions. There are also other considerations that help make it even more attractive. These include the strong trade agreements between Latin America and Australia, the vibrancy of its natural resources and mining sectors, and the shaky political and economic climates of countries such as USA, UK, and China.

Aside from the above, a vital consideration for foreign entrepreneurs is Australia’s ease of market entry.

Here’s a brief introduction to how foreign entrepreneurs could set up their businesses Down Under:

READ MORE: Hong Kong Australia Free Trade Pact Outcomes

Deciding On Your Business Structure

Naturally, the first step is deciding how your business is to be set up:

Sole trader: an individual trading in his own name;

Partnership: an association of people or entities conducting a business together (not as a company);

Trust: an entity standing as a fiduciary entity holding property or income for the benefit of its trustees;

Company: a separate legal entity distinct from its owners / shareholders. Companies in Australia must be registered with the Australian Securities and Investments Commission (“ASIC”). Or alternatively, one may also consider registering a business as a foreign company, or acquiring an existing Australian company.

The business structure adopted will have a bearing on factors such as:

Required licenses and paperwork to be submitted;

Taxation; and

Potential liability and control over business.

Luckily, the business structure adopted is not something that is fixed. As the business develops, investors are free to change the structure anytime they like to suit the business’ needs.

Australian Business Number (“ABN”)

The ABN Is a unique number by which the business would be identified by other businesses or the Australian government. It also enables a business to register a domain name ending with .au or .net.au. The registration is a simple process that may be completed online.

Business Name and Intellectual Property

Businesses should then proceed to decide on the name under which they will be trading. This may also be done online via the ASIC website, on which one may search the business names register to determine the desired name’s availability. Registration of available names can then be done at the Business Registration Service site.

As registration of business names do not necessarily grant the owner complete legal protection. Businesses should also consider protecting their trademarks and domain names.

DOCUMENT: Trademark Licence Agreement

Licences

Depending on the business’ nature, location and industry, different licences may be required for its lawful operation. The Australian government’s website is very comprehensive, listing every licence and how to obtain them.

Taxes

The paying of taxes are, of course, a given, and life will be infinitely easier for a business to have a clear system organised right from the business’ inception.

The Australian Taxation Office issues a unique Tax File Number (“TFN”) to all individuals and entities in Australia. This is a mandatory requirement. Sole traders and proprietors operating under their own names may use their own TFNs for taxation purposes. Partnerships, companies and trusts will however have to apply for one.

As in many other countries, there are different taxes to be paid depending on the business. Some examples include:

Goods and Services Tax (“GST”)

GST is payable under different circumstances. The most relevant ones would be where a business operates in the Goods and Services industry and has a turnover of $75,000 or more. Or if you’re a business importing services or digital goods individually worth less than $1,000 and make more than $75,000 annually.

Pay as You Go Withholding Tax (“PAYG”)

A business will have to apply for PAYG withholding tax if it is required to withhold tax from payments to workers, or other entities (i.e. employees, directors, contractors etc.) Businesses must first register for PAYG before the first occasion it is required to withhold tax.

Fringes Benefit Tax (“FBT”)

If the business provides some type of fringe benefits to its employees, such as work cars, payment of expenses like educational fees or health insurance costs, the business will first have to register for FBT.

Grants

Amongst the abundant support provided by the Australian government, one of the benefits of doing business in Oz are the numerous funds and grants. This again depends on the location and nature of the business. For instance, start-ups in Adelaide may be entitled to a $20,000 Small Business Development Fund. New businesses should pay attention to the potentially very useful tools and grants they may be entitled to.

Visas

Foreign entrepreneurs wishing to set up a business in Australia may be entitled to apply for Business Innovation and Investment Visas if they have been nominated by a state or territorial government. Such nominations may be applied for online.

One may also be eligible for a Business Talent Visa if one:

wholly or partially own an overseas business, have net business and personal assets of $1.5 million plus, and has an annual business turnover of at least 3 million;

or has obtained at least $1 million in venture capital funding in Australia for a high-value business idea.

Setting up a business is always a risky venture, especially when you’re setting one up in a foreign country. This risk however may be calculated and controlled if enough planning and careful consideration is invested beforehand.

This article does not constitute legal advice.

Start managing your legal needs with Zegal today

READ MORE: 5 Reasons to Start a Business in Australia